Tax season comes with a lot of anxiety for some. The thought of gathering receipts, calculating expenses and printing account statements can be overwhelming. This process can be even more if a hassle if you are a freelancer or self-employed. In addition to my W-2 income acting work, as a model, I am considered a 1099 independent contractor.

Luckily there are financial benefits from being self- employed, like the ability to write-off work related expenses against your income. The downside comes at the end of the year when the realization that no taxes have been held from your checks means you may owe the government a hefty amount.

Organizing and tracking your finances throughout the year is key to making tax time go smoother, here are a few tips to help all of us freelancers prepare for tax season.

Track & Record Your Income and Expenses

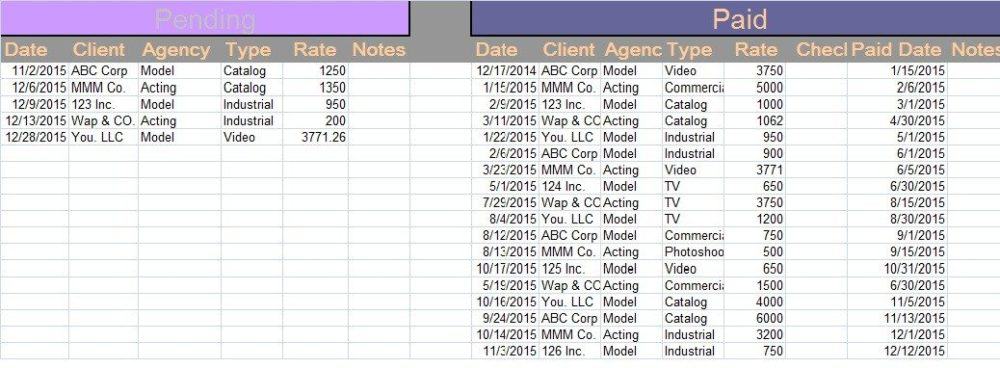

Tax season is the optimum time to review or initiate a process of tracking your income and expenditures. This log can make it easy for you to estimate taxes throughout the year, get a snapshot of your annual income, and provide a well-organized cache of information. For tracking my income, I use a simple excel spreadsheet that allows me to see all the jobs I have booked. Once I receive my check, I then move the job from “Pending” to “Paid.”

For my expenses, I use the site Expensify, which tracks my expenses from my credit card purchases and allows me to create expense reports that I can use to prepare my taxes. I create my expense categories tailored to my business and log cash purchases.

An added feature is that app allows you to upload photos of my receipts with the expense, so I don’t have to keep to track of it. No receipt, no problem, Expensify offers eReciepts for transactions up to $75 imported by your credit cards that are accepted by the IRS.

Save For Your Taxes with a High-Interest Savings Account

When you are a freelancer, you may not get paid every two weeks like a salaried employee. When you get paid the last thing you want to think about is saving for your taxes for the next year. Trust me—it’s easier to set aside some money throughout the year as opposed to paying a massive tax bill in one lump sum in April. Use your prior year tax bill as a guide and then determine to how much you should be putting away each month or quarter.

I have a High Yield Savings account from American Express, which currently offers .90 % APY. Set up automatic transfers from your checking account, which can make saving so much easier.

Pay Quarterly Taxes

If saving for your annual tax return sounds less than desirable then you should consider paying your taxes on a quarterly basis. The IRS states that as a self-employed individual you are required to file an annual return and pay quarterly returns out that if you think you’re going to owe more than $1,000 come tax time.

The good news is that if you end up paying too much for a quarter, that payment will carry over to the next quarter and offset that amount. Neglecting to pay quarterly taxes as a freelance may result in a penalty from the IRS.

Don’t Forget Your Write-offs

Keeping track of your day to day expenses are essential, but don’t forget those write-offs that are allowed by the IRS when you are filing a Schedule C as a part of your tax returns. If you work from home, the room you designate as your home office can be written off as an expense. You can also claim business travel and meals such as plane and train tickets, cabs and rental cars – as well as hotel costs are all deductibles.

If you travel for business in your vehicle, you can deduct 56.5 cents per mile (commuting from home to your office doesn’t count). In most cases, meals are deducted at 50% of the total cost. Lastly, don’t forget to write off retirement contributions to your personal 401K or a SEP (Simplified Employee Pension). These contributions are tax deductible and typically depend on your income.

Use a Professional Accountant

When you are self-employed, your taxes are a bit more complicated than someone whose employer calculates and withholds taxes out of every paycheck. Because of this, it’s a good idea to find an accountant or financial advisor to help you manage your money throughout the year.

They can do everything from help you decide how much of your paycheck you need to put away, to preparing your annual tax return. Also, many cases an accountant will do the heavy lifting for you if you happen to get audited by the IRS.

How do you prepare for tax season? Do you have any helpful tips for my readers?

41 comments

As a freelancer, you’re responsible for the bulk of your tax recordkeeping, filing and, of course, paying. This article will help sort through what you need to know and do to get your freelance taxes under control. Thank you very much for sharing it.

I am so glad that you enjoyed this post! It is so important to do the little things throughout the year that will help you be more prepared for tax time!

I am a freelancer. And tax reporting has always been a “dark forest” for me, to be honest 🙂 Great article, thank you Sherita!

I could use all of the tips you mentioned above. Thank you and continue sharing informative post!

Thank You for the amazing information.

Thank you for sharing this! This is a great help. Keep posting.

Thank You for this great information.

What great tips! I recommend this blog post to everyone.

These are all great tips! I could use them in the future.

These tips are great and awesome! This will be a great help for me.

Thanks for these tips

This is a great help. Thank you!

A very helpful article. I am self-employed, the above text is helpful – thank you.

These are all great tips! I could use them in the future.

This is such an amazing help.

I would use all of the suggestions you gave. Thank you for sharing this valuable information, and keep it coming!

These tips are great! Thank you for sharing this post.

Having a freelance Job is convenient but handling my tax is my major problem. Thank you for sharing this article. Will try this next time.

These tips are great! This is such a great help!

This is really perfect!

Such a great help and informative. Keep on sharing!

Thank you for this great information! Nice content.

Thank you for the ideas, they are wonderful recommendations for any emerging business to follow

Great post! Enjoyed reading it.

Great post! Thank you for this information.

Great tips when it comes to money.

Thank you for posting this amazing article.

When you freelance, you are a ‘business’ yourself .. That’s why I love freelancing because of the degree of control you have compare to being an employee of a company..

Very interesting. Thank you for this post!

thank you for posting, enjoyed this so much

Great information! Thank you for sharing.

These are really good tips for a freelancer, especially a beginner. It is very difficult to keep the tax part under control when you are not very good at it

These are really good tips for a freelancer, especially a beginner. It is very difficult to keep the tax part under control when you are not very good at it. Thanks for the helpfull information

Awesome post! Thank you for sharing and keep us posted.

Posted tips are really helpful.

Wow! Amazing content, keep on sharing.

Thank you for sharing! This is a great read 🙂

This is a good read thank you for sharing

This is an informative content and I like this very much. Keep us posted!

These are really great tips! Thank you for sharing this informative post.

Very informative! Thank you for sharing.